Current Status: BUY (Oversupply = opportunity for investors)

It shouldn’t be news to anyone that Miami’s real estate economy has failed to break free from it’s reliance on foreign investment. After all, the market is a melting pot of international developers who bring their newest design ideas to Miami to implement, test and refine before heading to other markets. The current development cycle led to a condo boom starting from early 2011 and Brazillian buyers poured into Miami to take advantage of exchange rates and the security of American assets. It should be no surprise that the Miami condo market is largely effected by the changing economic and political landscape in Brazil. As Brazil fell deep into turmoil in early 2016, the Miami real estate market stepped back to asses. How should investors play the market as we close in on Q4 2016?

Supply & The Developers:

South Florida currently has a 14-month supply, with a 6-month supply traditionally seen as the equilibrium. At this midway point in 2016, developers have completed 63 new condo towers, totaling over 4,900 units in Downtown Miami. 130 new buildings are currently under construction with 14,700 new units and another 221 condo buildings with 31,200 units are in the planning and pre-sale phase of development. As the market has seen a softening in early 2016, there have been at least 6 cancelled projects in Downtown Miami including Krystal Tower and Ion East Edgewater.

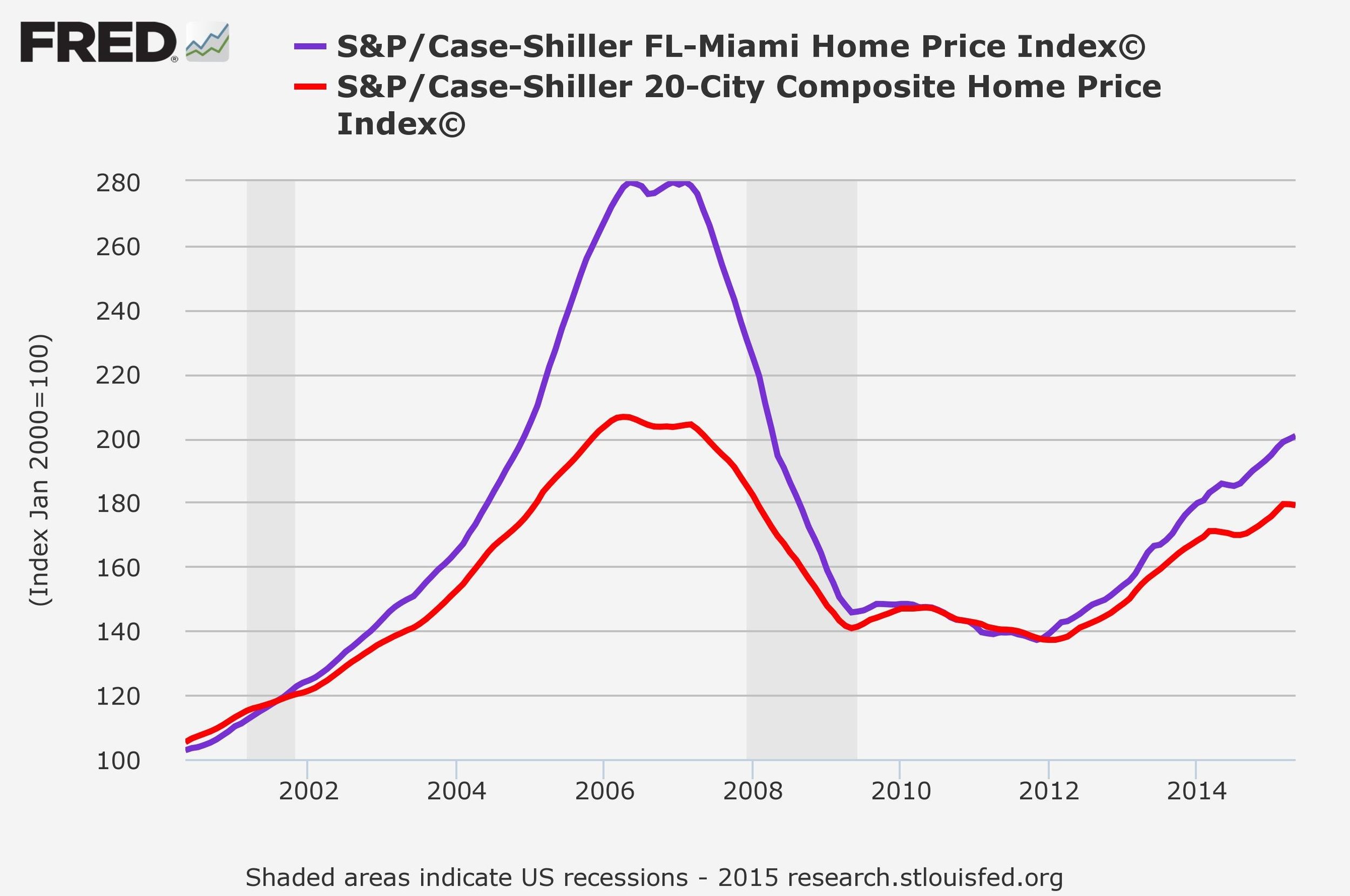

Developers see the current cycle to be more stable than the 2004-2008 cycle which was spurred by easy financing and quick rising prices. Today buyers must put 50% cash down and developers do not start a project until it is 80% sold so that deposits can cover a large portion of construction costs. Developers are lowering their pricing for projects in planning and pre-sale phase to spur demand and make the units more attractive to potential buyers, lowering risk.

Demand & The Consumer:

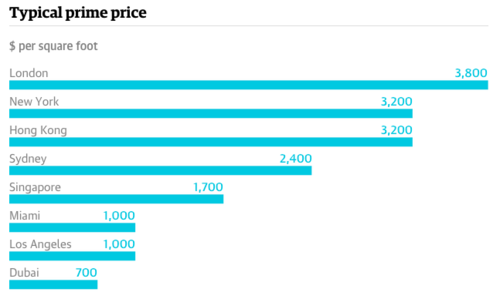

Sales velocity has fallen by considerable amounts, influenced by a mix of over-supply and weakening foreign currencies. A strong U.S. dollar, dropping oil prices and an uncertain global economic outlook has caused foreign investors to hit the brakes. Many of these factors have effected not only Miami, but also other top luxury real estate markets such as New York and Los Angeles. The Brazilian REAL has dropped over 42% compared to the U.S. Dollar, as has the Argentine Peso. Additionally, new laws targeting money launderers will negatively influence local real estate as the international community cracks down.

As South American buyers slow, a new group has visibly come out of the woodwork. There has been a significant increase in demand from New Yorkers and Chinese buyers who have began taking advantage of softening prices and investment opportunity. REALTORS have identified an opportunity to penetrate these wealthy markets that have historically not been amongst the driving force of the Miami Real Estate economy. While these buyers will not completely replace the loss of buyers from South America, it creates diversity in the market place and hedges against the loss of South American buyers. .

Outlook:

Miami is the number one destination for Millennials looking to move. Plain and simple, Miami is a city for the future. If the last 5 years of commercial development has proven anything, it’s that Miami is evolving into a world-class metropolis. Most of the condos built between 2004 and today never had a chance to appreciate. Downtown Miami, Edgewater, and until recently, Brickell, were plagued with nowhere to walk, nothing accessible, no public transportation and neighborhoods overrun with poverty and homeless. In the last year, this has completely changed as “city centers” such as Brickell City Centre, Design District, Midtown, etc. have developed into places that people desire to spend time. Miami is now a full city, and not just a place on the water with a hospitality, cruise and party industry. It stands to say that the demand for Millennials to live in Miami will not be stopping soon, giving investors a great opportunity because even if Millennials can’t afford to buy, they will still need to rent to live.

Financially, with low debt levels amongst buyers and developers alike, the Miami Real Estate Market is in much better position to sustain itself opposed to the 2008 crash. As we see more developers cancel undersubscribed projects and supply begin to correct itself, prices and sales velocity should begin to stabilize. With high demand to live in Miami mixed with an oversupply of inventory from the last development cycle and weak foreign markets, now is the time to buy in Miami. The market softening has opened up tons of opportunity across all markets of Miami. Whether you are interested in purchasing a condo for any use, multi-family rental property, or luxury-waterfront estate, now is the time to keep your eyes open for deals.